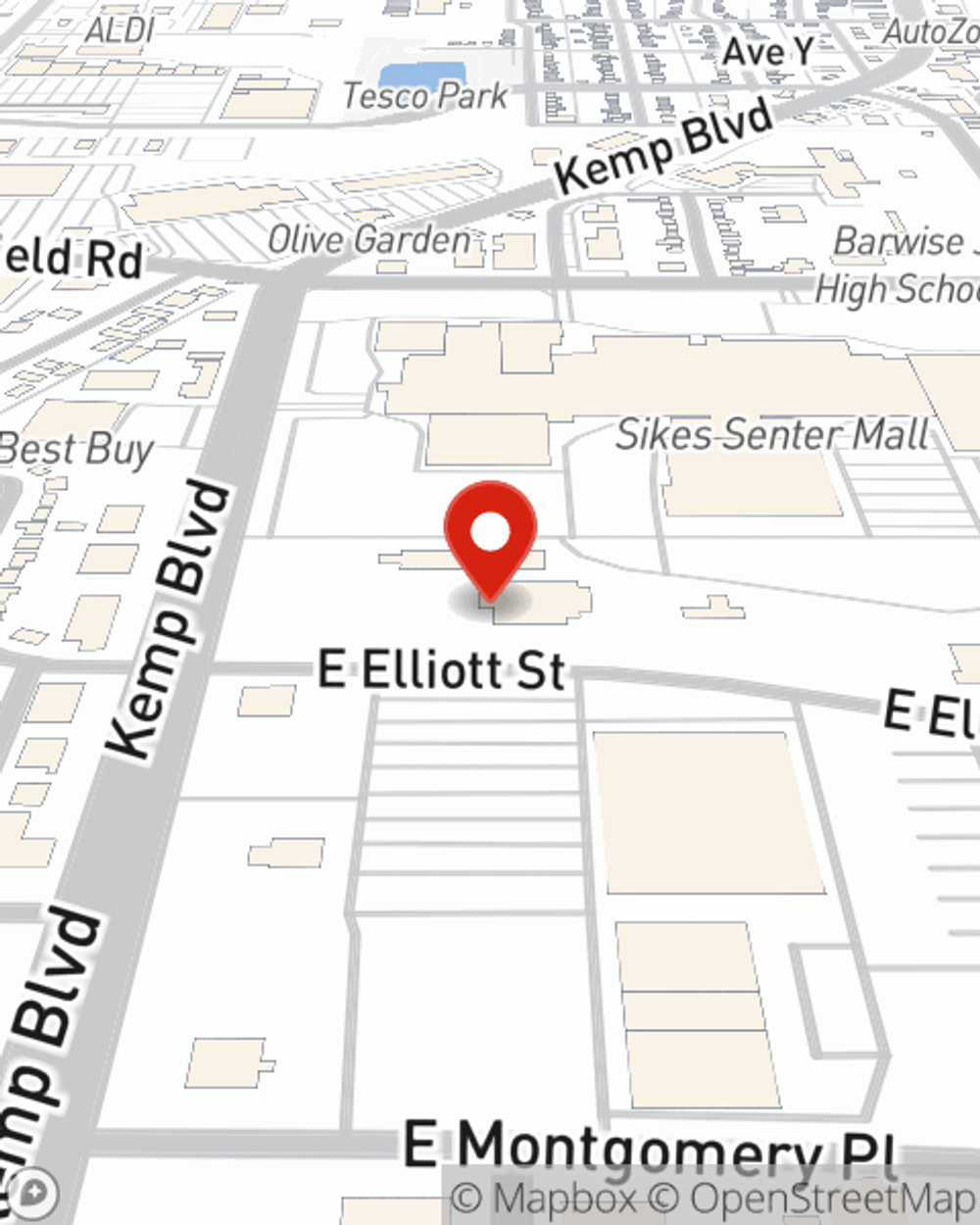

Business Insurance in and around Wichita Falls

Get your Wichita Falls business covered, right here!

This small business insurance is not risky

Help Protect Your Business With State Farm.

Small business owners like you have a lot of responsibility. From customer service rep to marketing guru, you do everything you can each day to make your business a success. Are you a physician, a dentist or a locksmith? Do you own a bridal shop, a deli or a pizza parlor? Whatever you do, State Farm may have small business insurance to cover it.

Get your Wichita Falls business covered, right here!

This small business insurance is not risky

Small Business Insurance You Can Count On

Your business thrives off your tenacity creativity, and having dependable coverage with State Farm. While you support your customers and lead your employees, let State Farm do their part in supporting you with worker’s compensation, commercial liability umbrella policies and commercial auto policies.

As a small business owner as well, agent Tim Short understands that there is a lot on your plate. Get in touch with Tim Short today to chat about your options.

Simple Insights®

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.

Tim Short

State Farm® Insurance AgentSimple Insights®

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.